Most Reno-Sparks sellers are surprised when they see their net proceeds at closing. They listed at $650,000, negotiated down to $640,000, and walked away with $568,000—$72,000 less than the final sale price. Where did that money go?

Understanding seller closing costs isn't just about avoiding surprises. It's about pricing your home correctly from day one, protecting your net proceeds, and making strategic decisions that maximize what you actually keep. In a market where November 2025 data shows homes taking 62-89 days to sell and sellers receiving approximately 98.5% of asking price, every dollar of your equity matters.

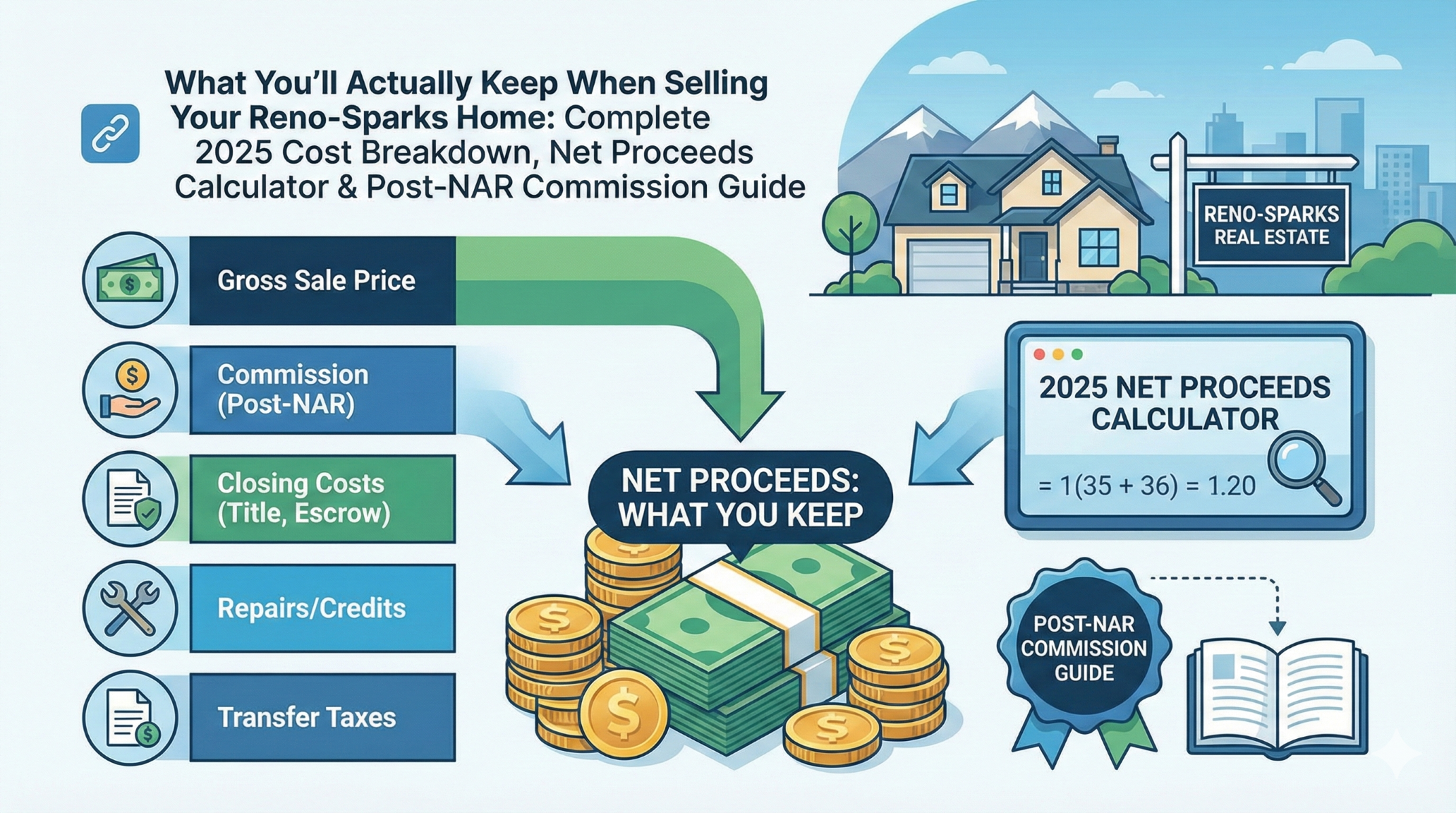

This guide breaks down every cost you'll face selling a Reno-Sparks home in 2025, explains the post-NAR settlement changes to commission structure, and provides actual net proceeds examples at multiple price points using current Washoe County rates.

The Complete Seller Cost Breakdown: Every Dollar Accounted For

Selling a home in Reno-Sparks involves multiple parties and fees. Here's what you'll pay and why:

Real Estate Commission (Largest Cost)

Listing Agent Commission: 2.5-3.0% of sale price

Your listing agent's commission compensates them for pricing strategy, professional photography, MLS listing, marketing, showings, negotiations, and transaction management from listing to closing.

Reno market data shows average total commission of 5.61% as of September 2025, typically split between listing and buyer agents. Listing agent fees commonly range from 2.5% to 3.0% depending on services provided, property complexity, and market conditions.

Buyer Agent Commission: 2.4-2.8% of sale price (negotiable)

This is where post-NAR settlement changes matter most. Prior to August 2024, sellers routinely offered buyer agent compensation through MLS listings. The NAR settlement changed three key things:

- Buyer agent compensation can no longer be advertised on MLS

- Buyers must sign representation agreements with their agents before touring homes

- Sellers are not legally required to pay buyer agent fees

What's Actually Happening in Reno-Sparks:

Despite these changes, market data shows most sellers still offer buyer agent compensation. National data from Redfin shows buyer agent commissions averaged 2.40% in Q1 2025, up from 2.37% in Q4 2024. Commissions have remained remarkably stable post-settlement because:

- Buyers typically cannot afford $8,000-15,000 agent fees from savings

- Seller-paid compensation removes financing barriers

- Properties offering compensation attract more buyer interest

- New construction builders continue paying 3%+ to buyer agents, creating competitive pressure

In balanced or buyer-favoring markets like current Reno-Sparks conditions, strategic sellers choose to offer 2.4-2.8% to buyer agents to maximize their buyer pool and competitive positioning.

The Strategic Conversation:

We have thorough discussions with every seller about buyer agent compensation. We analyze:

- Competition from new construction in your area

- Your target buyer demographic and their financing capacity

- Current market velocity in your neighborhood and price point

- Strategic timing of your listing

In most Reno-Sparks transactions, offering buyer agent compensation expands your buyer pool, accelerates your sale, and often recoups the cost through stronger offers and faster closing.

Washoe County Transfer Tax

Cost: $2.05 per $500 of sale price (or any fraction thereof)

Nevada charges $1.95 per $500 statewide, with Washoe County adding $0.10 per $500. This one-time tax is due when the deed transfers ownership from seller to buyer.

Calculation examples:

- $500,000 home: 1,000 increments × $2.05 = $2,050

- $650,000 home: 1,300 increments × $2.05 = $2,665

- $800,000 home: 1,600 increments × $2.05 = $3,280

The transfer tax is paid at closing and collected by the Washoe County Recorder's office. Unlike some closing costs, this fee is typically non-negotiable and paid by the seller in Reno-Sparks custom, though contract terms can specify otherwise.

Escrow and Title Services

Escrow Fee: $400-800 (split with buyer in Reno-Sparks custom)

Escrow companies handle the closing process: holding earnest money, coordinating with lenders, ordering title work, preparing closing documents, disbursing funds, and recording the deed. Basic escrow services for residential sales typically cost $500-1,500 total depending on transaction complexity, with buyer and seller each paying half in standard Reno-Sparks practice.

Title Insurance (Owner's Policy): 0.5-0.8% of sale price

In Northern Nevada, sellers customarily pay for the owner's title insurance policy that protects the buyer against title defects. Title insurance is a one-time premium paid at closing based on purchase price.

Approximate costs:

- $500,000 home: $2,500-4,000

- $650,000 home: $3,250-5,200

- $800,000 home: $4,000-6,400

Title insurance rates vary by company. Nevada Division of Insurance notes that for $150,000 of coverage in some Nevada counties, combined owner's and lender's policies range from $1,046 to $1,407, showing significant rate variation between title companies.

HOA-Related Costs (If Applicable)

HOA Transfer Fee: $100-500 per applicant

If your home is in a homeowners association, you'll pay administrative fees to transfer HOA records to the new owner. These fees cover document preparation, updating community records, issuing new access credentials, and providing required disclosures.

HOA transfer fees in Nevada commonly range from $100-500, though some communities with extensive amenities charge more. The fee is typically paid by the seller in Reno-Sparks practice, though negotiable in the purchase contract.

HOA Document Preparation: $100-300

Separate from the transfer fee, HOAs charge for preparing resale packages that include governing documents, financial statements, meeting minutes, and required disclosures. These documents are legally required in HOA transactions and must be provided to the buyer during their due diligence period.

Prorated HOA Dues: Variable

You'll pay HOA dues through your closing date. If you paid quarterly or annually in advance, you'll receive a credit for the period after closing. Conversely, if dues are unpaid, they'll be deducted from your proceeds.

Property Tax Proration

Amount: Variable based on closing date

Property taxes in Washoe County are paid in arrears, meaning the bill you receive covers the previous tax period. At closing, you'll pay your share of property taxes through your ownership date, and the buyer assumes responsibility from that point forward.

If you've already paid property taxes beyond your closing date, you'll receive a credit. If taxes are unpaid, they're deducted from your proceeds.

Recording Fees

Cost: $25-85 per document

The county charges fees to record the deed transferring ownership to the buyer. Recording fees in Washoe County vary by document type and page count but typically total $25-85 for standard residential transactions.

Additional Seller Costs to Anticipate

Home Warranty (Optional): $400-800

Some sellers offer a home warranty to buyers as a marketing tool or negotiated concession. Home warranties covering major systems and appliances typically cost $400-800 annually in Northern Nevada.

Offering a home warranty can:

- Provide buyer peace of mind, especially for first-time purchasers

- Reduce post-inspection repair negotiations

- Differentiate your property in competitive markets

The strategic decision depends on your property's condition, buyer expectations in your price range, and current market dynamics.

Inspection-Related Repairs: $500-5,000+

Buyer inspections typically identify maintenance items, safety concerns, or deferred repairs. Negotiated repair costs vary dramatically based on:

- Property age and condition

- Inspection findings

- Market leverage (seller's vs. buyer's market)

- Buyer financing requirements

In current Reno-Sparks market conditions where days on market have increased and buyers have moderate negotiating power, sellers should budget for reasonable repair requests or price adjustments based on inspection findings.

Final Utility Bills and Services: $100-400

You're responsible for utilities through closing day. Final bills for electricity, gas, water, sewer, and trash typically total $100-400 depending on the closing date within your billing cycles.

Moving and Storage Costs: Variable

While not a closing cost, moving expenses impact your net proceeds planning. Local Reno-Sparks moves average $500-2,500 depending on home size and distance. If your purchase and sale don't align perfectly, temporary storage may add $150-400 monthly.

Net Proceeds Calculator: What You'll Actually Keep at Four Price Points

These examples use current Reno-Sparks market data and typical Washoe County closing costs. Your actual costs will vary based on specific property circumstances, negotiated contract terms, and service provider rates.

Example 1: $500,000 Sale Price

Sale Price: $500,000

Costs:

- Listing agent commission (2.8%): $14,000

- Buyer agent commission (2.6%): $13,000

- Washoe County transfer tax: $2,050

- Escrow fee (seller's half): $400

- Owner's title insurance: $3,000

- HOA transfer and documents: $300

- Prorated property taxes (estimated): $1,800

- Recording fees: $50

- Inspection repairs (estimated): $1,500

- Final utilities: $200

Total Costs: $36,300

Net Proceeds: $463,700

Percentage to Seller: 92.7%

Example 2: $650,000 Sale Price

Sale Price: $650,000

Costs:

- Listing agent commission (2.8%): $18,200

- Buyer agent commission (2.6%): $16,900

- Washoe County transfer tax: $2,665

- Escrow fee (seller's half): $500

- Owner's title insurance: $4,000

- HOA transfer and documents: $350

- Prorated property taxes (estimated): $2,300

- Recording fees: $50

- Inspection repairs (estimated): $2,000

- Final utilities: $250

- Home warranty (optional): $600

Total Costs: $47,815

Net Proceeds: $602,185

Percentage to Seller: 92.6%

Example 3: $800,000 Sale Price

Sale Price: $800,000

Costs:

- Listing agent commission (2.8%): $22,400

- Buyer agent commission (2.6%): $20,800

- Washoe County transfer tax: $3,280

- Escrow fee (seller's half): $600

- Owner's title insurance: $5,000

- HOA transfer and documents: $400

- Prorated property taxes (estimated): $2,800

- Recording fees: $85

- Inspection repairs (estimated): $2,500

- Final utilities: $300

- Home warranty (optional): $700

Total Costs: $58,865

Net Proceeds: $741,135

Percentage to Seller: 92.6%

Example 4: $1,000,000 Sale Price

Sale Price: $1,000,000

Costs:

- Listing agent commission (2.75%): $27,500

- Buyer agent compensation (2.5%): $25,000

- Washoe County transfer tax: $4,100

- Escrow fee (seller's half): $750

- Owner's title insurance: $6,500

- HOA transfer and documents: $500

- Prorated property taxes (estimated): $3,500

- Recording fees: $85

- Inspection repairs (estimated): $3,000

- Final utilities: $350

Total Costs: $71,285

Net Proceeds: $928,715

Percentage to Seller: 92.9%

Key Insight: Regardless of price point, sellers typically net 92-93% of sale price after all costs in Reno-Sparks transactions. Commission represents 55-65% of total costs, making agent negotiation and buyer agent compensation strategy critical to maximizing proceeds.

How Costs Affect Your Pricing Strategy

Understanding your costs upfront prevents a critical pricing mistake: working backwards from your desired net proceeds.

The Dangerous Math:

Many sellers think: "I need $600,000 for my next home. My costs will be about $50,000. I'll list at $650,000."

The Problem:

This approach ignores market dynamics, comparable sales, and buyer perception. If market data suggests your home should sell for $625,000 and you list at $650,000:

- Property sits on market longer

- Days on market increase buyer skepticism

- You're forced into price reductions

- Final sale price often ends up lower than strategic initial pricing

November 2025 Reno data shows homes averaging 62-89 days on market. Properties that sit significantly longer than neighborhood averages often sell for less, even after reductions, than strategically priced homes that sell within 30-45 days.

The Strategic Approach:

- Determine accurate market value through comparative market analysis

- Price at or slightly below market value for maximum buyer activity

- Calculate expected net proceeds at that price point

- Adjust financial planning accordingly

If your needed net proceeds exceed realistic market value, your options are:

- Delay selling until market conditions improve

- Invest in high-ROI improvements that justify higher pricing

- Adjust your next purchase budget to align with actual proceeds

Pricing strategy isn't about covering your costs—it's about positioning your property competitively to attract multiple buyers, strong offers, and optimal value within current market conditions.

Post-NAR Settlement: Understanding Your Commission Options

The August 2024 NAR settlement fundamentally changed how agent compensation is structured, but not how most transactions actually close in Reno-Sparks.

What Changed Legally

Before NAR Settlement:

- MLS listings displayed offered buyer agent compensation

- Buyers often unaware they could negotiate agent fees

- Seller-paid buyer agent commission was standard practice

After NAR Settlement:

- Buyer agent compensation cannot be advertised on MLS

- Buyers must sign representation agreements before touring homes

- Buyers and agents must agree to compensation upfront

- Sellers choose whether to offer buyer agent compensation

What Stayed the Same in Practice

National data shows minimal actual change in commission amounts:

- Q1 2025 buyer agent commission: 2.40% (Redfin data)

- Q4 2024 buyer agent commission: 2.37%

- Q3 2024 buyer agent commission: 2.36%

Commissions briefly dipped when the settlement was announced, then returned to previous levels as market forces reasserted themselves.

Why Reno-Sparks Sellers Still Offer Buyer Agent Compensation

Financial Reality for Buyers:

First-time buyers saving for a 3.5% down payment on a $550,000 Reno home need $19,250 for their down payment. Adding $13,000-15,000 in agent fees creates a financing barrier that eliminates many qualified buyers from your pool.

Competitive Positioning:

When neighboring listings and new construction properties offer buyer agent compensation, properties without it face reduced showings. Buyer agents can't ethically steer clients away from properties offering zero compensation, but they can explain financing challenges to buyers who must pay agent fees from pocket.

Faster Sale Velocity:

Properties accessible to the full buyer pool—including those using financed transactions where buyer agent fees are seller-paid—typically sell faster. In Reno-Sparks current market conditions averaging 62-89 days on market, accelerating your sale by 2-3 weeks saves carrying costs (mortgage, insurance, utilities, maintenance) that often exceed the buyer agent compensation you're offering.

Strategic Decision Framework

We recommend discussing buyer agent compensation based on:

Your Property Type:

- Luxury homes ($1M+): Buyers often have flexibility; lower/zero compensation may work

- Mid-market homes ($400K-800K): Strong competition from new construction paying 3%; offering compensation recommended

- Entry-level homes (under $400K): First-time buyers need seller-paid compensation to close

Your Market Position:

- High-demand neighborhoods: More negotiating leverage

- Slower neighborhoods: Compensation helps attract buyers

- Competing with new construction: Match or exceed builder offers

Your Timeline:

- Need quick sale: Offer competitive compensation

- Can wait for right buyer: More flexibility on compensation structure

Hidden Costs Sellers Often Miss

Beyond standard closing costs, these expenses surprise sellers:

Mortgage Payoff Statement Fees: $0-50

Your lender charges a small fee to provide the exact payoff amount, including per-diem interest through closing day.

HOA Capital Assessment or Special Assessment Payoffs

If your HOA has levied special assessments for community improvements, these must be paid current at closing or disclosed as buyer assumption.

Homestead Exemption Adjustment

If you've received Washoe County's homestead exemption (property tax reduction for primary residences), your final tax bill may be adjusted if the exemption is removed, creating a small additional amount due.

Short Sale or Underwater Situations

If you owe more than your home is worth, selling requires lender approval and potentially brings-money-to-closing or negotiated deficiency agreements. These situations require experienced agent representation to navigate lender short sale departments.

Capital Gains Tax (Federal)

While not a closing cost, federal capital gains tax may apply if:

- You've owned the home less than two years

- Your gain exceeds $250,000 (single) or $500,000 (married)

- The home wasn't your primary residence for 2 of the past 5 years

Capital gains situations require tax professional consultation as they can significantly impact your net proceeds planning.

Strategies to Maximize Your Net Proceeds

Understanding costs is only half the equation. Maximizing what you keep requires strategic execution:

Strategic Timing

Selling during peak spring/summer market activity (March-July in Reno-Sparks) typically generates more buyer competition, stronger offers, and faster closings than slower fall/winter periods. If you can control timing, understand strategic listing timing based on current market conditions.

High-ROI Improvements

Not all improvements add value. Focus on:

- Professional deep cleaning and minor repairs ($500-1,500 investment typically returns 100%+)

- Fresh neutral paint in key areas ($1,000-2,500 investment can return $3,000-5,000 in perceived value)

- Curb appeal improvements ($500-2,000 investment strongly influences first impressions)

- Updated light fixtures and hardware ($300-800 investment modernizes at low cost)

Avoid major renovations before selling unless specifically recommended by your agent based on comparable sales in your area. A $30,000 kitchen remodel rarely returns full value in the sale price.

Negotiation Leverage Through Preparation

Homes in move-in condition with minimal inspection concerns give you stronger negotiating position. Budget $1,000-3,000 for pre-listing improvements and maintenance items your inspector would flag:

- HVAC servicing

- Minor plumbing leaks

- Electrical safety issues

- Roof condition concerns

Proactive addressing of these items reduces post-inspection repair negotiations and shows buyers a well-maintained property.

Commission Negotiation

All commission rates are negotiable. However, commission negotiation should focus on value delivered, not just rate reduction:

Questions to Ask:

- What's included in your marketing plan?

- How do you handle negotiations and multiple offers?

- What's your average days-on-market vs. area average?

- What's your sale-to-list price ratio?

A skilled agent earning 2.8% who sells your home in 30 days at 99% of asking price delivers better net proceeds than a 2.0% agent who takes 90 days and nets you 96% of asking price.

When considering buyer agent compensation, understand how agent selection impacts your overall outcome.

Strategic Pricing

Pricing 3-5% below market value in competitive markets can trigger multiple offers that drive final sale price above listing price. This counterintuitive strategy works when:

- Inventory is relatively low in your price range

- Your property shows exceptionally well

- Timing aligns with peak buyer activity

Aggressive underpricing works better in hot markets. In balanced Reno-Sparks conditions, price at market value based on solid comparable sales analysis.

The Real Cost of Price Reductions

National data shows June 2025 market conditions where 49% of listings experienced price reductions. Price reductions carry hidden costs beyond the obvious reduction amount:

Extended Days on Market:

Every additional week on market costs you:

- Mortgage payment: $2,500-4,000+ monthly on $500K-800K homes

- Property insurance: $150-300 monthly

- Utilities: $200-400 monthly

- Maintenance: $100-300 monthly

- Opportunity cost: Delayed purchase of next home

Buyer Perception:

Properties reduced from $650,000 to $625,000 signal seller motivation, inspection concerns, or overpricing. Buyers often submit offers below the reduced price, assuming further reductions are possible.

Appraisal Impact:

Price reductions within 90 days of going under contract appear on appraisal comparable sales analysis, potentially impacting the appraised value and creating buyer financing challenges.

Strategic Prevention:

Correct initial pricing, based on current market data and comparable sales, prevents the price reduction cascade. Work with agents who understand strategic pricing for upper-mid to luxury properties to position your home correctly from day one.

Reno-Sparks Market Context: December 2025

Understanding your costs matters more in current market conditions:

Market Data:

- Median sale prices: $541,000 (Redfin, November 2025)

- Days on market: 58 days (up from 52 days year-over-year)

- Sale-to-list ratio: Approximately 98.5%

- Market conditions: Balanced, with moderate buyer negotiating power

What This Means for Sellers:

Current conditions favor strategic sellers who:

- Price accurately based on comparable sales, not aspirational values

- Present homes in move-in condition to minimize inspection negotiations

- Understand carrying costs and price to sell within 45-60 days

- Offer competitive buyer agent compensation to maximize buyer pool

- Work with experienced local agents who navigate balanced market dynamics

The market has shifted from the aggressive seller's market of 2021-2022, but remains stable with consistent buyer demand, particularly from California relocations and local employment growth in tech and logistics sectors.

Ready to Maximize Your Net Proceeds?

Understanding seller costs is step one. Strategic execution is step two.

Contact Kevin Kinney at 775-391-8402 or Robin Renwick at 775-813-1255 to schedule a comprehensive listing consultation. We'll discuss:

- Detailed comparative market analysis specific to your neighborhood

- Strategic pricing based on current market velocity in your area

- Projected net proceeds at various price points

- Buyer agent compensation strategy for your property and price range

- High-ROI preparation priorities before listing

- Marketing approach tailored to your target buyer

- Timeline and negotiation strategy aligned with your goals

Let's create a strategic plan that maximizes your net proceeds and positions your home for competitive market success.

The Kinney & Renwick Team

Kevin Kinney – 775-391-8402

Robin Renwick – 775-813-1255

[email protected]

kinneyandrenwickteam.com

Frequently Asked Questions

How much will I actually net from selling my Reno home?

Sellers in Reno-Sparks typically net 92-93% of the sale price after all costs. For a $650,000 sale, expect net proceeds of approximately $600,000-605,000 depending on specific HOA fees, inspection repair negotiations, and agreed-upon commission rates. The largest costs are listing agent commission (2.5-3.0%), buyer agent compensation if offered (2.4-2.8%), and title insurance (0.5-0.8%). Use the detailed calculators in this guide or contact us for a personalized net proceeds analysis based on your specific property and situation.

Do I have to pay the buyer's agent commission after the NAR settlement?

No, you're not legally required to pay buyer agent compensation. However, market data shows most Reno-Sparks sellers still offer buyer agent compensation (typically 2.4-2.8%) for strategic reasons. Offering compensation expands your buyer pool by making your property accessible to buyers who can't pay agent fees from pocket, removes financing barriers, and creates competitive positioning against new construction that typically pays 3%+ to buyer agents. We help every seller evaluate whether offering buyer agent compensation makes strategic sense based on their specific property, price point, and market timing.

What are Washoe County transfer taxes when selling a home?

Washoe County transfer tax is $2.05 per $500 of sale price or any fraction thereof. This includes Nevada's base rate of $1.95 plus Washoe County's additional $0.10 per $500. For a $500,000 home, transfer tax is $2,050. For an $800,000 home, it's $3,280. The transfer tax is typically paid by the seller in Reno-Sparks custom, though contract terms can specify otherwise. This one-time tax is collected by the Washoe County Recorder's office at closing when the deed transfers ownership from seller to buyer.

Should I make repairs before selling my Reno-Sparks home?

Strategic pre-listing improvements typically include professional cleaning, minor repairs, fresh neutral paint, and addressing obvious maintenance items your home inspector would flag. Budget $1,000-3,000 for high-return improvements. Avoid major renovations unless specifically recommended by your agent based on comparable sales—a $30,000 kitchen remodel rarely returns full value in sale price. Focus on items that eliminate buyer objections and reduce post-inspection repair negotiations. Homes in move-in condition sell faster and often command stronger prices than properties requiring buyer repairs, even when initial cost is higher.

How long does it take to sell a home in Reno-Sparks right now?

November 2025 data shows Reno homes averaging 58 days on market, up from 52 days year-over-year. However, correctly priced homes in desirable neighborhoods often sell within 30-45 days, while overpriced or condition-challenged properties can sit 90+ days. Market velocity varies significantly by price point, neighborhood, and seasonal timing. Spring and summer (March-July) typically see faster sales than fall and winter periods. Strategic pricing, strong presentation, and competitive buyer agent compensation offerings influence days on market more than any other controllable factors.

What closing costs can I negotiate with the buyer?

Several costs are negotiable through the purchase contract. Traditionally in Reno-Sparks, sellers pay listing agent commission, Washoe County transfer tax, owner's title insurance, and half the escrow fee, while buyers pay buyer agent fees, lender's title insurance, and the other half of escrow. However, in buyer-favoring market conditions, buyers may request sellers to cover some buyer costs such as home warranty, portion of buyer closing costs, or specific repairs identified in inspections. Negotiability depends on market conditions, property condition, and strength of buyer offers. In current balanced market conditions, expect some cost negotiation as part of standard offer process.

How do HOA fees affect my closing costs?

If your property is in a homeowners association, expect HOA transfer fees ($100-500 per applicant), document preparation fees ($100-300), and prorated HOA dues through closing date. Some HOAs charge capital contribution or reserve fund fees to new buyers. If your HOA has levied special assessments for community improvements, these must be paid current or disclosed for buyer assumption. Total HOA-related closing costs typically range from $200-800 depending on your specific association's fee structure. Review your HOA's CCRs and contact HOA management early in the listing process to identify exact fees and requirements.

Should I offer a home warranty to buyers?

Home warranties covering major systems and appliances cost $400-800 annually in Northern Nevada. Offering a home warranty can provide buyer peace of mind (especially for first-time purchasers), reduce post-inspection repair negotiations, and differentiate your property in competitive markets. The strategic decision depends on your property's age and condition, buyer expectations in your price range, and current market dynamics. Newer homes with modern systems may not benefit from warranty offerings, while older homes with aging mechanical systems can reduce buyer concerns by including a warranty. We help sellers evaluate whether home warranty investment makes strategic sense for their specific situation.