The following analysis combines national housing data released February 12, 2026, with local Reno-Sparks MLS statistics and regional economic data from EDAWN's 2026 State of the Economy presentation. National figures reflect existing home sales as reported by industry sources. Local statistics sourced from Domus Analytics/NNRMLS updated through January 2026.

If you checked the news this morning, you probably saw some alarming numbers. National existing home sales dropped 8.4% from December and 4.4% compared to a year ago, bringing the seasonally adjusted annual rate to 3.91 million — the slowest pace since December 2023. (National Association of Realtors, February 12, 2026.)

That sounds bad. And if you're a Reno-Sparks homeowner thinking about selling this spring, your first instinct might be to wait. To freeze. To see what happens next.

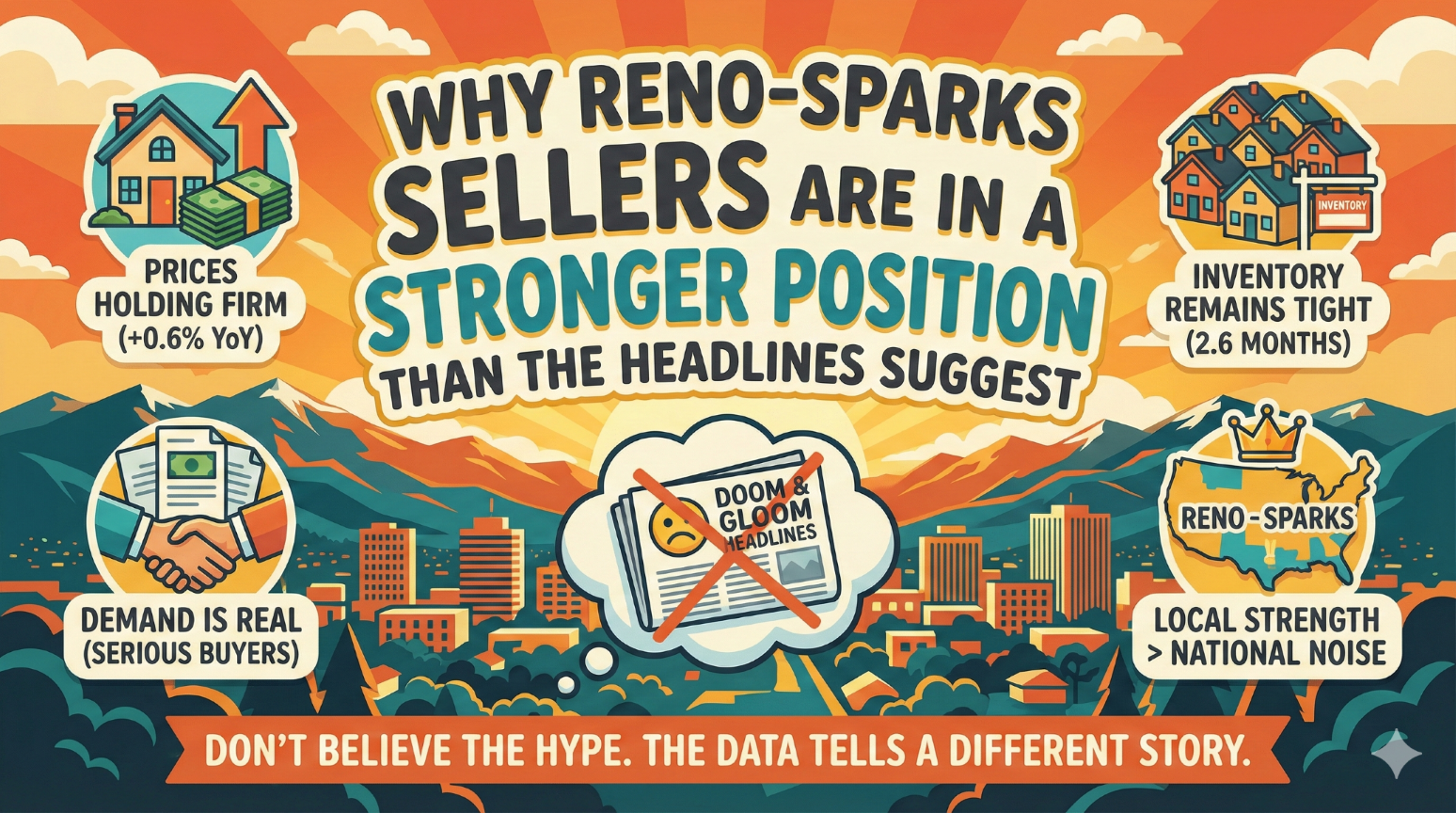

That instinct is understandable. It's also the wrong move for most sellers in this market — and particularly for sellers in Reno-Sparks, where the local story looks nothing like the national headline.

Here's what actually happened, what it means locally, and why strategic sellers positioned for spring are sitting in one of the strongest positions in years.

The National Picture Has More Good News Than the Headlines Let On

Let's start with what the headlines didn't tell you.

Yes, sales volume dropped. But that 8.4% month-over-month decline landed in January — a month where below-normal temperatures and above-normal precipitation made it harder than usual to assess underlying demand. January closings reflect contracts signed in November and December, during the holiday slowdown. Weather compounded an already seasonal dip.

Now look at what happened underneath that headline number.

Housing affordability reached its highest level since March 2022, with the national affordability index climbing to 116.5 — up from just 102 a year ago. (National Association of Realtors Housing Affordability Index, January 2026.) That's a meaningful shift. Wages are now growing faster than home prices, and mortgage rates sit nearly 80 basis points lower than a year ago. The 30-year fixed-rate mortgage averaged 6.09% this week, down from 6.87% in February 2025. (Freddie Mac Primary Mortgage Market Survey, February 12, 2026.)

Sam Khater, Freddie Mac's chief economist, put it plainly: "Bolstered by strong economic growth, a solid labor market and mortgage rates at three-year lows, housing affordability continues to measurably improve. These factors have caught the attention of many prospective homebuyers, driving purchase application activity higher than a year ago."

That's not someone describing a market in crisis. That's someone describing a market warming up.

The median national home price rose to $396,800 — the 31st consecutive month of year-over-year increases. (National Association of Realtors, February 12, 2026.) Inventory ticked up 3.4% year-over-year to 1.22 million units. First-time buyers accounted for 31% of purchases, up from 28% a year ago. And the only price segment showing year-over-year growth in transaction volume was $1 million and above.

Read that last point again if you own a quality home at upper-mid to higher price points. The segment of the market where well-prepared, well-priced properties trade is the one segment that grew nationally through a winter slowdown.

Why Reno-Sparks Tells a Different Story

National data is useful for context. But it's not your market. Sellers in Damonte Ranch, Somersett, and Caughlin Ranch aren't competing against homes in Phoenix or Charlotte. They're operating in an economy that is fundamentally outperforming the national picture.

Consider what's happening locally.

The Reno metropolitan area was designated the #1 Leading Metro for economic growth out of 949 national metros, according to EDAWN's 2026 State of the Economy presentation delivered February 5, 2026. Not top ten. Not top five. Number one.

In 2025 alone, EDAWN documented $534 million in new business investment flowing into the region, with 593 new jobs at an average salary of $76,800. The Reno-Las Vegas corridor was ranked the #1 fastest-growing data center hub in the country — ahead of Salt Lake City, Phoenix, Atlanta, and Dallas-Fort Worth — with growth rates reaching 953%. (Upwind/JLL 2024 Data Center Report, cited in EDAWN presentation.) And the region's startup ecosystem attracted $1 billion in venture capital over the past year, including Reno's first tech unicorn.

That kind of economic momentum creates housing demand. Companies relocating here need employees. Employees need homes. And unlike markets propped up by speculative buying, Reno's demand is driven by actual job creation and actual people moving here for actual opportunities.

Nevada ranked #10 nationally for inbound migration in 2025, with family reasons (20.5%), retirement (19.9%), and employment (19.9%) as the top motivators. (United Van Lines 2025 National Movers Study, cited in EDAWN presentation.) Those aren't flippers. Those are permanent residents with purchasing power — many arriving from California, Oregon, and Washington with significant home equity.

Wondering what kind of buyers are actually entering this market? Many of them are well-capitalized relocators making the move from California with six-figure equity positions from their previous home sales. That equity gives them down payment power that insulates them from rate sensitivity more than national averages suggest.

The Local Numbers Confirm the Strength

Our January 2026 Reno-Sparks market update — published with actual MLS data from Domus Analytics before any competitor had January numbers — showed a market that's seasonal, not struggling.

Here's the snapshot:

In Reno, the median sale price for single-family homes came in at $580,000 with sellers receiving 98.6% of their asking price. In Sparks, the median landed at $525,000 with 98.8% list price received. Per-square-foot values — a better stability indicator than headline median when seasonal volume dips — held essentially flat in Reno at $325 per square foot and actually increased 3.5% year-over-year in Sparks to $292 per square foot.

Months of supply in Reno sat at 2.6 months. In Sparks, just 2.0 months. Anything under three months indicates seller-favorable conditions. For context, a balanced market is typically defined as five to six months of supply.

Curious what your home's position looks like in this market? Contact Kevin Kinney at 775-391-8402 or Robin Renwick at 775-813-1255 for a pricing analysis specific to your neighborhood and price range.

Those aren't numbers from a distressed market. Those are numbers from a market where supply remains tight, values are holding, and properly priced homes are still commanding near-full asking price.

Why Spring 2026 Favors Prepared Sellers

Here's where the national headline actually works in your favor — if you're strategic about it.

The dramatic "sales crash" narrative will keep some sellers on the sidelines. Homeowners who were thinking about listing in March or April will read the headline, feel uncertain, and decide to wait until the market "stabilizes." Some will postpone until summer. Others until fall. A few will put the idea off entirely.

That hesitation thins out your competition at the exact moment when buyer activity picks up seasonally. Historically, the strongest showing activity in Reno-Sparks runs from late February through May. Buyers who've been watching rates improve — and they have improved, by nearly a full percentage point since last February — start scheduling tours once daylight extends and weather cooperates.

Lisa Sturtevant, chief economist at Bright MLS, noted that with improved inventory, lower mortgage rates, and slower price growth, she expects more home shoppers out early this spring. (Real Estate News, February 12, 2026.)

Think about the math. A buyer purchasing at Reno's $580,000 median with 20% down pays a monthly principal and interest of approximately $2,779 at today's 6.09% rate. At last year's 6.87% rate, that same purchase cost roughly $3,055 per month. That's $276 per month in savings — or more than $3,300 per year — without any change in the home's price.

For a Sparks buyer at the $525,000 median, the monthly savings at 6.09% versus 6.87% comes to approximately $250 per month. Over a year, that's $3,000 more purchasing power in a buyer's pocket. Buyers feel that difference. It shows up in their confidence and their willingness to make offers.

And here's the dynamic that rewards sellers who list ahead of the spring competition wave: nationally, homes that sold in January received an average of 2.2 offers, and 16% sold above their asking price. (National Association of Realtors, REALTORS Confidence Index, January 2026.) In a market that supposedly "crashed," one in six sellers still got more than they asked for.

The Equity Position Most Sellers Don't Fully Appreciate

There's another piece of this puzzle that gets lost in headline-driven anxiety.

Since January 2020, the typical American homeowner has accumulated approximately $130,500 in housing wealth. (National Association of Realtors, February 12, 2026.) In Reno-Sparks, where median prices have outpaced many national markets over the past five years, that figure is likely higher for homeowners who purchased before 2022.

Nationally, about two-thirds of homeowners hold substantial equity positions: 39% own their homes outright, and another 27% have at least 50% equity. (U.S. Census and ATTOM, cited in Keeping Current Matters, February 12, 2026.) The typical homeowner carries nearly $300,000 in total equity. (Cotality Q4 2025.)

For empty nesters considering a downsize, that equity is the engine that makes the transition work — often allowing buyers to purchase their next home with little or no mortgage. According to data cited in EDAWN's presentation, 49% of older baby boomers are buying their next home with cash. The equity in your current home is what funds that option.

For move-up sellers who've been locked into a low mortgage rate, the equity cushion changes the math on rate differences. When you're rolling $300,000 or more in equity into your next purchase, the monthly payment difference between your old rate and today's rate shrinks dramatically — because you're financing a much smaller loan relative to the home's value.

What This Means for Your Spring Decision

If you're sitting on a quality home in ArrowCreek, Northwest Reno, Double Diamond, Galena Forest, or Spanish Springs, here's the honest assessment.

The national headline is noise. It's January. It was cold. Holiday contracts were thin. These are facts, not trends.

The fundamentals tell a different story: affordability is improving. Rates are at three-year lows. Reno's economy is ranked first in the nation for growth. Buyer demand from relocation, retirement, and employment continues to build. Local supply remains tight. And your equity position — built over years of ownership — gives you flexibility that many sellers in other markets don't have.

The sellers who will capture the strongest outcomes this spring are the ones who prepare now, price strategically, and present their homes before the competition wave arrives in May and June. The right listing representation matters — not because the market is difficult, but because in a market with this much opportunity, the difference between a good outcome and an exceptional one comes down to preparation, pricing, and positioning.

Thinking about how to position your home for a spring sale? Contact Kevin Kinney at 775-391-8402 or Robin Renwick at 775-813-1255 for a strategic analysis of your neighborhood's current conditions and what your equity position makes possible.

That's not optimism. That's what the data shows. And in this market, the data favors sellers who act with confidence rather than react to fear.

If you're considering a move this spring, the conversation worth having isn't whether to sell — it's how to sell in a way that captures the full value of your position. We'd welcome a thoughtful conversation about your goals, your timeline, and what the numbers look like for your specific property and neighborhood.

Contact Kevin Kinney at 775-391-8402 or Robin Renwick at 775-813-1255 to discuss your spring selling strategy.

DELIVERABLE 3: FAQs

Q: Did the housing market crash in January 2026? A: No. National existing home sales declined 8.4% month-over-month, largely attributed to below-normal temperatures, above-normal precipitation, and the typical holiday-season slowdown in contract signings. The national affordability index reached its highest point since March 2022, and home prices continued their 31-month streak of year-over-year increases.

Q: Are Reno-Sparks home values declining? A: Per-square-foot values — a more reliable stability measure than seasonal median fluctuations — held essentially flat in Reno at $325/sqft (+0.2% year-over-year) and increased 3.5% in Sparks to $292/sqft in January 2026. Sellers in both markets received 98.6-98.8% of their asking price.

Q: Is spring 2026 a good time to sell a home in Reno? A: Spring 2026 presents a strong window for prepared sellers. Mortgage rates are at three-year lows (6.09%), buyer affordability is the best since March 2022, and Reno's economy ranks #1 nationally for growth. Sellers who list before the late-spring competition wave typically face less competition and more motivated buyers.

Q: How much equity does the typical homeowner have right now? A: The typical U.S. homeowner holds nearly $300,000 in equity. In Reno-Sparks, where median prices have outpaced national averages, long-term homeowners may hold even more. Since January 2020, the average homeowner has accumulated approximately $130,500 in housing wealth.

Q: Why is the Reno housing market different from the national market? A: Reno's economy is outperforming national trends. The metro was ranked #1 for economic growth out of 949 national metros, with $534 million in new business investment, 593 new jobs at $76,800 average salary, and the #1 fastest-growing data center hub in the country. This economic foundation creates sustained housing demand independent of national cycles.

Q: How much have mortgage rates dropped compared to last year? A: The 30-year fixed-rate mortgage averaged 6.09% as of February 12, 2026 — down nearly 80 basis points from 6.87% a year ago. On a $580,000 Reno home with 20% down, that translates to approximately $276 per month in savings for buyers, which increases their purchasing power and willingness to make offers at asking price.

Q: Should I wait for rates to drop further before selling? A: Waiting for lower rates could mean listing into a more crowded spring and summer market as other sellers make the same calculation. The current environment — three-year-low rates, improving affordability, tight local inventory, and strong economic fundamentals — creates favorable conditions for sellers who are prepared to act strategically.

Q: What makes a home sell for the strongest price in the current Reno market? A: In a market where sellers are receiving 98.6-98.8% of asking price, the difference between a good outcome and an exceptional one comes down to strategic pricing, professional presentation, and timing. Homes that are properly staged, accurately priced for their neighborhood, and listed during peak showing activity consistently outperform.