*Market data as of November 2025. Strategic insights based on current market conditions. Verify specific neighborhood pricing and program details with Kevin Kinney (775-391-8402) or Robin Renwick (775-813-1255).*

November 2025 brought distinct market patterns to Reno and Sparks, with both cities showing clear seasonal adjustments as we move deeper into the traditionally slower winter months. While national headlines focus on rising interest rates and economic uncertainty, the Northern Nevada market tells a more nuanced story—one where sellers maintain pricing power while inventory tightens significantly heading into the holiday season.

The November data reveals a tale of two markets moving in parallel but with unique characteristics. Reno saw continued price appreciation and tightening inventory despite slower transaction velocity, while Sparks demonstrated remarkable pricing stability with its tightest inventory levels of the year. For sellers considering listing before 2026 and buyers hoping to secure homes with less competition, understanding these November trends isn't just helpful—it's essential for strategic positioning.

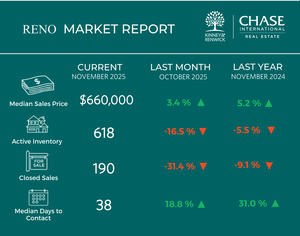

Reno Market Analysis: November 2025

Reno's November numbers paint a picture of a market that's matured significantly from the frenzy of 2021-2022 but remains fundamentally strong for sellers willing to price strategically.

Pricing Strength Continues

The median sales price hit $660,000 in November, representing solid appreciation of 5.2% compared to November 2024 and a healthy 3.4% increase from October. This upward momentum contradicts some national narratives about softening prices and demonstrates that well-positioned Reno properties continue capturing value. At $343 per square foot, Reno's price-per-square-foot metric climbed 3.3% month-over-month, suggesting buyers aren't simply paying more for larger homes—they're paying more per square foot across the board.

For sellers, this pricing environment remains favorable. Homes are selling at 98.5% of list price on average, essentially matching asking price with minimal negotiation. This sale-to-list ratio has held remarkably steady throughout 2025, indicating that properly priced homes aren't facing the deep discounts some predicted earlier in the year.

Transaction Volume Reflects Seasonal Patterns

Closed sales dropped to 190 transactions in November, down 9.1% year-over-year and 31.4% from October's stronger showing. This decline aligns with typical seasonal patterns as buyers and sellers both pull back during the holiday season. However, the year-over-year comparison is more telling—a 9% decline suggests modestly softer demand compared to November 2024, likely influenced by sustained mortgage rates in the 6.5-7% range throughout fall 2025.

New listings fell even more dramatically, declining 35.6% from October to just 203 new properties hitting the market. This sharp drop in new supply creates an interesting dynamic: while fewer buyers are active, significantly fewer sellers are competing for their attention.

Inventory Tightens Significantly

Active inventory dropped to 618 homes in November, down 5.5% year-over-year and 16.5% from October. This inventory contraction is particularly notable given that Reno saw inventory expand earlier in 2025. The months' supply of inventory sits at 3.3 months—comfortably in seller's market territory (below the 4-6 month balanced range) and trending upward only modestly despite the seasonal slowdown.

For context, Reno's inventory peaked around 1,200-1,600 homes during mid-2025 before contracting back toward these levels. The current 618-home inventory represents a market where sellers who list now face meaningfully less competition than those who waited through summer and fall.

Days on Market Tell the Speed Story

Median days to contract stretched to 38 days in November, up 31% year-over-year and 18.8% from October. This metric captures the reality that homes are taking longer to sell than in 2023-2024, but 38 days remains relatively quick by historical standards. Pre-COVID Reno markets typically saw 45-60 days to contract, so we're still operating faster than "normal" despite the slowdown from pandemic-era velocity.

The longer timeline benefits both buyers and sellers differently. Buyers gain more time for due diligence, property comparisons, and negotiation. Sellers need to prepare for realistic timelines—the days of weekend offers are largely behind us, but well-priced homes in desirable neighborhoods still move decisively.

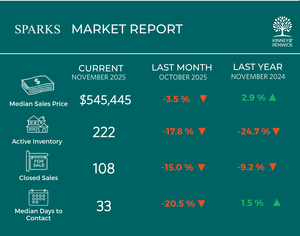

Sparks Market Analysis: November 2025

Sparks demonstrated its own distinct market character in November, with tighter inventory conditions and faster transaction times despite slightly softer pricing.

Pricing Shows Modest Adjustment

The median sales price in Sparks settled at $545,445 in November, up 2.9% year-over-year but down 3.5% from October's $565,000. This monthly pullback likely reflects seasonal mix shifts—November tends to bring more mid-range transactions as luxury buyers and sellers pause for the holidays. At $289 per square foot, Sparks maintains its position as offering strong value relative to Reno's $343 per square foot.

Sellers in Sparks captured 98.9% of their asking price on average, actually outperforming Reno's 98.5% ratio. This suggests that while absolute prices are lower, pricing precision matters tremendously—Sparks sellers who understand their neighborhood's competitive position are securing nearly full asking price with minimal concessions.

Sales Velocity Moderates

Closed sales totaled 108 transactions in November, down 9.2% year-over-year and 15% from October. Similar to Reno, this reflects both seasonal patterns and moderating demand. New listings declined 16.7% from October to 95 homes, creating supply constraints that partially offset the demand softening.

Tightest Inventory of the Year

Sparks' active inventory compressed to just 222 homes in November—down a substantial 24.7% year-over-year and 17.8% from October. This represents one of the tightest inventory conditions Sparks has experienced in 2025. The months' supply metric sits at just 2.1 months, firmly in seller's market territory and actually tighter than Reno's 3.3-month supply.

For Sparks sellers, this inventory dynamic creates genuine leverage. With only 222 competing listings across the entire city, properly positioned homes stand out dramatically. For Sparks buyers, the limited selection means decisiveness matters—hesitation often means missing opportunities entirely.

Transaction Speed Advantage

Median days to contract in Sparks came in at 33 days—five days faster than Reno and actually 20.5% quicker than October. This faster velocity suggests that well-priced Sparks homes are attracting committed buyers who move decisively. The 33-day timeline represents efficient market clearing, where homes priced correctly for current conditions find buyers quickly.

Reno vs. Sparks: Strategic Market Comparison

The November data reveals interesting strategic differences between these adjacent markets:

Pricing Dynamics: Reno commands a $115,000 premium over Sparks ($660,000 vs. $545,445), with the gap widening slightly from recent months. On a per-square-foot basis, Reno's $343 vs. Sparks' $289 represents an 18.7% premium. For buyers seeking value, Sparks continues offering strong opportunities—particularly in Spanish Springs, Damonte Ranch, and South Meadows neighborhoods where you get comparable or newer construction at lower absolute prices.

Inventory Conditions: Both markets show tight inventory, but Sparks' 2.1-month supply is notably tighter than Reno's 3.3 months. This means Sparks sellers face even less competition, while Sparks buyers face more limited choices. If you're a buyer with flexibility on location, Reno's slightly deeper inventory pool provides more options for comparison shopping.

Transaction Timeline: Sparks' 33-day median vs. Reno's 38 days suggests that Sparks properties priced correctly move faster. This could reflect Sparks' positioning as a value play—buyers who've done their research and understand the value proposition commit more quickly.

Market Momentum: Reno's stronger year-over-year price growth (5.2% vs. 2.9%) indicates continued appreciation momentum, while Sparks offers relative price stability. For investors, Reno's trajectory suggests stronger near-term appreciation potential; for first-time buyers or those prioritizing monthly payment affordability, Sparks' stability creates predictable budgeting.

What This Means for Sellers

If you're considering listing in late 2025 or early 2026, November's data provides clear strategic guidance:

Inventory Advantage Is Real: With active listings down significantly in both markets, you'll face less competition now than you would have in summer or early fall 2025. Fewer competing properties means your listing gets more attention from the buyers who are active.

Pricing Precision Matters More Than Ever: The 98.5-98.9% sale-to-list ratios tell you that buyers aren't dramatically overbidding, but they're also not demanding steep discounts. Price your home correctly from day one using current comparable sales, and you'll capture close to asking price. Overprice by even 5%, and you risk sitting through the slower winter months with mounting days-on-market that ultimately force a price reduction below where you should have started.

38-Day Timeline Is Your New Reality: Gone are the weekend-offer days for most properties. Plan for 30-45 days to secure a buyer, plus another 30-45 days for escrow. If you need to close before a certain date, back out your listing date accordingly and build in contingency time.

Preparation Pays Off: In a market where buyers have more time to evaluate properties, presentation quality differentiates winners from properties that linger. Professional photography isn't optional—it's essential. Address deferred maintenance before listing. In neighborhoods with HOAs, understand what buyers are comparing your home against and position accordingly.

Strategic Timing Considerations: Listing in December-January means facing the slowest buyer activity of the year, but competing against the fewest sellers. Listing in February-March catches the spring surge of buyers but faces more competition. Choose your timing based on whether you'd rather fish in a smaller pond with a smaller net or a bigger pond with more fishermen.

Ready to position your home strategically in the current Reno or Sparks market? Contact Kevin Kinney at 775-391-8402 or Robin Renwick at 775-813-1255 to schedule a comprehensive listing consultation. We'll discuss your home's competitive position, strategic pricing based on current November data, preparation priorities that maximize value, and a marketing approach tailored to your specific neighborhood and timeline. Let's turn your home equity into your next opportunity with a data-driven listing strategy.

What This Means for Buyers

November's market conditions create distinct opportunities for buyers willing to act strategically:

Negotiation Room Exists—Within Reason: The 98.5-98.9% sale-to-list ratios mean you're not paying significantly over asking, but you're also unlikely to secure 10-15% discounts except on overpriced properties that have sat for 60+ days. Reasonable negotiation means offering 97-100% of asking on well-priced homes, requesting seller concessions for repairs or closing costs, and potentially negotiating rate buy-downs where sellers are motivated.

Time Is Your Ally: With 33-38 day median timelines, you're no longer forced into sight-unseen offers or waived contingencies. Use that time wisely—conduct thorough inspections, research neighborhood comps, understand HOA financials if applicable, and make informed decisions rather than rushed ones.

Inventory Constraints Require Decisiveness: While you have more time per property than in 2021-2022, the limited overall inventory (222 homes in Sparks, 618 in Reno) means hesitation costs opportunities. When you find the right home, move decisively through your due diligence and be prepared to commit.

Financing Strategy Matters: With rates in the 6.5-7% range and unlikely to drop dramatically in Q4 2025 or Q1 2026, focus on total monthly payment rather than fixating on rate. Explore down payment assistance programs through Nevada Housing Division—programs like Home Is Possible offer up to 4% assistance with forgivable second mortgages for qualified buyers. Work with a knowledgeable mortgage broker (we work closely with Mark Graham at Sanctuary Funding, 775-691-8103, [email protected]) who can access multiple loan products and potentially find better terms than single-lender options.

Value Positioning: Sparks continues offering strong value relative to Reno, particularly in Spanish Springs ($500,000-600,000 range), South Meadows (excellent schools), and Damonte Ranch (newer construction). In Reno, Northwest Reno and Southwest Reno neighborhoods provide more established feel at mid-range prices, while Spanish Springs and Sun Valley offer entry points below $500,000.

Spring Market Is Coming: If you can wait, February-March 2026 will bring more inventory as sellers who held off through holidays re-enter the market. However, you'll also face more buyer competition. The advantage of buying now in November-January is less competition, more seller motivation, and avoiding the spring rush.

Ready to explore Reno or Sparks neighborhoods strategically? Contact Kevin Kinney at 775-391-8402 or Robin Renwick at 775-813-1255 to schedule a buyer consultation. We'll tour properties together, discuss neighborhood fit based on your priorities, analyze market positioning for each option you're considering, and create a strategic buying plan that maximizes your negotiation leverage in the current market. Let's find the perfect Northern Nevada home for your family.

The Kinney & Renwick Team

Kevin Kinney – 775-391-8402

Robin Renwick – 775-813-1255

[email protected]

kinneyandrenwickteam.com

Frequently Asked Questions

Is November 2025 a good time to sell a home in Reno or Sparks?

November presents a strategic opportunity for sellers in both markets. Active inventory has dropped significantly—down to 618 homes in Reno and just 222 in Sparks, creating less competition for your listing. While buyer activity is seasonally slower, the serious buyers who are active face limited choices, potentially giving you leverage. The key is pricing accurately from day one—homes are selling at 98.5-98.9% of asking price, so strategic pricing captures close to full value without prolonged market time. If you can prepare your home properly and don't need to wait for spring, listing now means facing fewer competing properties.

How long does it take to sell a home in Reno-Sparks in November 2025?

Median days to contract came in at 38 days in Reno and 33 days in Sparks during November 2025. This represents the time from listing to accepted offer, with an additional 30-45 days typically needed for escrow and closing. Compared to the 7-14 day timelines of 2021-2022, today's market gives buyers more time for due diligence. Well-priced homes in desirable neighborhoods like Somersett, Damonte Ranch, and Northwest Reno still move faster—often securing offers within 20-25 days—while overpriced properties can sit for 60-90+ days before requiring price reductions.

Are Reno home prices still going up in November 2025?

Yes, Reno's median sales price of $660,000 in November represents 5.2% year-over-year appreciation and 3.4% growth from October. This demonstrates continued price strength despite higher interest rates. Sparks showed 2.9% year-over-year growth with more monthly volatility. The appreciation pace has moderated significantly from the 15-20% annual increases of 2021-2022, returning to more sustainable 3-5% annual growth that tracks closer to historical norms. Well-maintained homes in desirable neighborhoods continue appreciating, while properties requiring significant updates or in less-desirable locations may see flatter performance.

What's the difference between the Reno and Sparks real estate markets?

Reno commands a pricing premium with a $660,000 median vs. Sparks' $545,445—a $115,000 difference. On a per-square-foot basis, Reno averages $343 while Sparks comes in at $289, reflecting Reno's closer proximity to downtown, Midtown, and Lake Tahoe. Sparks offers strong value, particularly in Spanish Springs and Damonte Ranch, with newer construction and excellent schools at lower absolute prices. Inventory is tighter in Sparks (2.1 months' supply) compared to Reno (3.3 months), and Sparks properties sell slightly faster (33 vs. 38 days). For buyers prioritizing value and newer homes, Sparks delivers; for those wanting more urban amenities or established neighborhoods, Reno's premium reflects tangible lifestyle differences.

Should I wait until spring 2026 to list my Reno or Sparks home?

The decision depends on your timeline and competition tolerance. Listing now (November-January) means facing minimal competition—active listings are down significantly in both markets. The buyers who are active during winter months tend to be more serious and motivated (relocations, job changes, life transitions) rather than casual spring shoppers. However, buyer activity is undeniably slower during holidays. Listing in February-March 2026 will bring more buyer traffic but substantially more competing listings as sellers who held off through winter enter the market simultaneously. If your home shows well and you can price it correctly, the reduced competition now may offset the reduced buyer activity. For homes requiring significant preparation or those in neighborhoods that show better in spring/summer, waiting may make sense.

What mortgage rates can buyers expect in Reno-Sparks for November 2025?

Mortgage rates in November 2025 are hovering in the 6.5-7% range for well-qualified buyers with strong credit (720+ scores) and 20% down payments. Rates for buyers with lower credit scores or smaller down payments can push toward 7-7.5%. These rates remain elevated compared to the 3-4% environment of 2020-2021 but have stabilized after the sharp increases of 2022-2023. Working with a mortgage broker rather than a single lender can potentially save 0.25-0.5% by accessing multiple loan products and competitive pricing. Nevada's down payment assistance programs (Home Is Possible, Home First) can help qualified first-time buyers reduce upfront costs, making monthly payments more manageable despite higher rates.

How does Reno inventory compare to normal market conditions?

Reno's November 2025 inventory of 618 active listings sits below historical norms but has rebounded from the extreme lows of 2021-2022 when inventory dipped below 400 homes. Pre-COVID normal inventory for Reno typically ranged from 1,000-1,600 homes, so current levels represent a market still favoring sellers but not as dramatically as during the pandemic years. The 3.3 months' supply remains well below the 4-6 months considered balanced, indicating continued seller leverage. However, we're seeing a gradual normalization—inventory has climbed from mid-2025 lows and will likely continue slowly increasing through 2026 as more sellers adjust to the "new normal" of 6-7% mortgage rates rather than waiting indefinitely for a return to 3-4% rates.

What neighborhoods in Reno and Sparks offer the best value in November 2025?

In Sparks, Spanish Springs offers newer construction in the $500,000-600,000 range with strong schools and family-oriented amenities. Damonte Ranch provides similar pricing with excellent Damonte Ranch High School access. South Meadows straddles the Reno-Sparks border with homes in the $520,000-650,000 range and top-rated elementary schools. In Reno, Northwest Reno neighborhoods provide established homes with mature landscaping in the $480,000-620,000 range, offering value relative to luxury areas like Somersett or Caughlin Ranch. For buyers seeking entry points under $450,000, Sun Valley and Lemmon Valley offer larger lots and more space, though with longer commutes to central Reno. Value is relative to your priorities—schools, commute time, lot size, and home age all factor into the equation.

We track market data across Northern Nevada including Carson City, Fernley, Minden/Gardnerville, and other regional markets. Contact us for detailed reports on these areas.