Market data and mortgage rates referenced are current as of publication date and subject to change. This article is for informational purposes only and does not constitute financial or real estate advice. Consult qualified professionals before making real estate decisions.

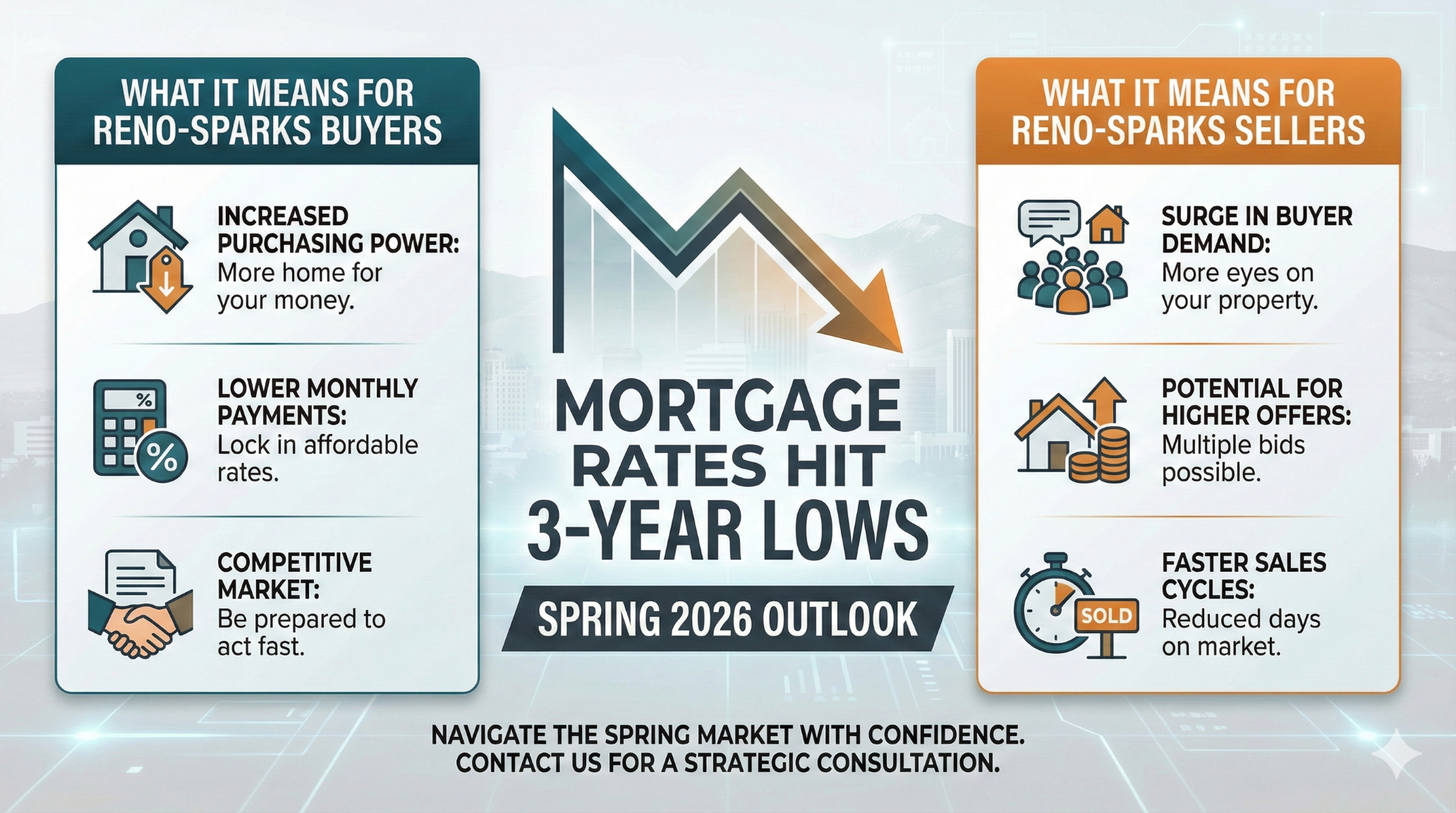

The news that mortgage rates dropped to their lowest level in more than three years arrived just as Reno-Sparks homeowners and buyers were mapping out their spring plans. According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.06% for the week ending January 15, 2026—down from 7.04% just one year ago. That nearly full percentage point decline translates into real savings: lower monthly payments for buyers, and more qualified purchasers in the market for sellers considering a strategic listing. Whether you're weighing a purchase in Somersett, preparing to list your Damonte Ranch home, or simply watching market conditions before making a move, understanding how these rate shifts affect Northern Nevada's housing landscape puts you in control of your next chapter.

Why Mortgage Rates at 3-Year Lows Changes the Spring 2026 Picture

The phrase "lowest in more than three years" isn't marketing spin—it's data straight from Freddie Mac's Primary Mortgage Market Survey, the industry's benchmark for tracking weekly rate averages. The last time rates dipped to these levels was September 2022, before the Federal Reserve's aggressive rate-hiking cycle pushed borrowing costs above 7% for much of 2023 and 2024. Sam Khater, Freddie Mac's chief economist, summarized the shift clearly: "Housing activity is improving and poised for a solid spring sales season."

What makes this moment particularly noteworthy is the combination of lower rates and strengthening buyer demand. The Mortgage Bankers Association reported that purchase applications jumped 16% in the week ending January 9, 2026, with refinance activity surging 40% over the same period. Joel Kan, MBA's vice president and deputy chief economist, noted that purchase applications "were almost 18 percent higher than last year." These aren't abstract statistics—they represent thousands of families nationally moving from the sidelines into active home searches.

For Reno-Sparks sellers, this wave of renewed buyer activity arrives at an opportune moment. More buyers with improved purchasing power means homes that are strategically priced and properly prepared can attract stronger offers without languishing through extended market times.

The Real Math: What Rate Drops Mean for Reno-Sparks Monthly Payments

Numbers tell the story more clearly than any headline. Let's run the calculations using actual Reno market conditions:

Using Reno's December 2025 Median Sale Price of $549,000:

With a 10% down payment ($54,900), you're financing $494,100.

At last January's rate of 7.04%: Monthly principal and interest = approximately $3,297

At today's rate of 6.06%: Monthly principal and interest = approximately $2,986

Monthly savings: $311 Annual savings: $3,732 Savings over 30 years: Approximately $112,000

For buyers relocating from California with larger down payments—a common scenario in our market—the math becomes even more compelling. A buyer bringing $200,000 in equity from a Bay Area sale and financing $349,000 on a $549,000 Reno home would see monthly payments of approximately $2,112 at 6.06% versus $2,332 at 7.04%, saving $220 monthly or roughly $79,000 over the life of the loan.

These savings change qualification calculations too. That $311 monthly difference on the median-priced home could mean buyers who were previously stretched now comfortably qualify, while buyers with more headroom can consider neighborhoods they'd previously thought beyond reach—perhaps looking at Caughlin Ranch instead of settling for locations further from their ideal.

National Market Momentum: December's Strongest Sales in Nearly Three Years

The rate drop didn't happen in isolation. The National Association of Realtors reported that existing-home sales increased 5.1% in December 2025—the fourth consecutive month of gains and the strongest December performance in nearly three years. Lawrence Yun, NAR's chief economist, put this in perspective: "2025 was another tough year for homebuyers, marked by record-high home prices and historically low home sales. However, in the fourth quarter, conditions began improving, with lower mortgage rates and slower home price growth."

This represents a meaningful shift from the housing market freeze that characterized 2023 and much of 2024-2025. Sales reached an annualized rate of 4.35 million units in December, with all four major regions showing month-over-month gains. For context, NAR forecasts home sales to increase approximately 14% nationwide in 2026.

The improved activity also reflects a gradual easing of what economists call the "lock-in effect"—the reluctance of homeowners with ultra-low pandemic-era mortgages to sell and take on higher rates. According to Realtor.com's January 2026 analysis, the share of U.S. homeowners with mortgage rates above 6% (21.2%) has now surpassed the share holding rates below 3% (20.0%). Danielle Hale, Realtor.com's chief economist, explained: "This crossover reflects a gradual resetting as some homeowners who had delayed moving jumped when rates softened."

This matters enormously for our Reno-Sparks housing inventory. More sellers entering the market means more choices for buyers and potentially less frantic competition than the bidding-war environment of 2021-2022.

What This Means for Reno-Sparks Sellers Planning Spring Listings

If you've been contemplating a sale—whether you're downsizing from a Somersett golf course home, moving up from a Northwest Reno starter, or relocating entirely—the current rate environment creates favorable conditions for several reasons.

More Qualified Buyers Entering the Market

Lower rates directly expand the pool of buyers who can qualify for mortgage financing. A household that couldn't afford the payment at 7% may now qualify comfortably at 6%. This enlarged buyer pool increases demand for listings across all price ranges, from Spanish Springs townhomes to ArrowCreek estates.

The Lock-in Effect Is Loosening—But You Still Have Leverage

While more sellers may enter the market as the lock-in effect eases, we're still well below normal inventory levels historically. Reno's months of supply remains around 3 months according to recent data—below the 5-6 month range that indicates a balanced market. Sellers who list in early spring, before the traditional surge in inventory, position themselves to capture buyer attention while competition is still manageable.

California Relocations Continue Strong

Northern Nevada's steady stream of approximately 50,000 California relocations annually continues unabated. These buyers often arrive with substantial equity from Bay Area, Sacramento, or Southern California sales. Their California equity effectively cushions them against rate sensitivity—whether rates are 6% or 6.5%, they're often putting significant amounts down and borrowing less than local buyers. This sustained demand supports Reno-Sparks home values even as national markets show signs of moderation.

Spring 2026 Timing Looks Favorable

Redfin's 2026 housing predictions specifically call for "a stronger spring homebuying season in 2026 because mortgage rates were sitting around 6.8% during the spring of 2025, meaningfully higher" than current rates. Daryl Fairweather, Redfin's chief economist, added broader context: "People who have felt locked in their homes may be turning down job opportunities, they may be delaying getting married, they may be delaying having a baby, all because they feel trapped in a home that doesn't meet their needs."

For sellers whose life circumstances require a move—the 5 Ds of real estate (Diplomas, Diapers, Divorce, Downsizing, Death)—this spring offers improved conditions compared to recent years.

What This Means for Reno-Sparks Buyers Ready to Purchase

Buyers who have been monitoring rates and waiting for improvement now face a decision: act on current conditions or continue hoping rates drop further. Here's what the data suggests:

Current Rates Represent Meaningful Improvement

Rates at 6% to 6.1% are approximately a full percentage point below where they stood a year ago. While economists don't expect a return to the 3% pandemic-era rates—Fannie Mae's January 2026 forecast predicts rates hovering around 6% for most of 2026 and 2027—the current level represents the most buyer-friendly rate environment in over three years.

Purchase Applications Signal Competition Is Returning

The 16% jump in purchase applications reported by MBA suggests other buyers are responding to improved conditions. Waiting for further rate drops while buyer competition intensifies could mean facing multiple offers and above-asking purchases on desirable properties.

Nevada Down Payment Assistance Remains Available

For buyers concerned about upfront costs, Nevada's Home Is Possible program offers up to 4% of the loan amount in down payment and closing cost assistance—forgivable after three years. The Home First program provides up to $15,000 in down payment support for first-time buyers who've been Nevada residents for at least six months. Combined with FHA loans requiring only 3.5% down, paths to homeownership exist even for buyers without massive savings.

Neighborhoods to Consider at Various Price Points

Current conditions make different Reno-Sparks neighborhoods accessible depending on your budget and priorities:

- Under $450,000: Spanish Springs, North Valleys, and certain Sparks locations offer entry points with room for appreciation

- $450,000-$600,000: Damonte Ranch, Double Diamond, and portions of South Reno provide family-friendly neighborhoods with strong schools

- $600,000-$800,000: Northwest Reno, portions of Caughlin Ranch, and Somersett entry-level homes combine quality construction with desirable locations

- $800,000+: ArrowCreek, Montreux, and Somersett's premium sections offer luxury living with Sierra Nevada views

Why Spring 2026 Could Be the Most Balanced Market in Years

Multiple data points suggest 2026 may finally deliver the balanced market buyers and sellers have sought since the pandemic disrupted normal patterns:

Inventory Is Rebuilding Gradually

Active listings nationally are approximately 20% above year-ago levels according to NAR, with similar trends visible in Northern Nevada. This gives buyers more choices without flooding the market to the point where sellers lose all leverage.

Price Appreciation Is Moderating

National forecasts call for home price growth of 1-3% in 2026—roughly matching inflation rather than the double-digit appreciation of 2021-2022. In Reno-Sparks, Redfin data showed December 2025 prices up 5.2% year-over-year to a median of $549,000, with homes selling at approximately 98% of asking price.

Wage Growth Is Outpacing Home Prices

For the first time since the Great Recession aftermath, incomes are expected to grow faster than home prices for a sustained period. This gradual improvement in affordability makes purchases more sustainable for buyers entering the market.

Days on Market Have Stabilized

Reno homes are currently averaging 60-66 days on market according to various sources—longer than the frenzied 20-30 day averages of 2021-2022, but not the 90+ day stretches that characterized previous buyer's markets. This middle ground allows buyers time to make thoughtful decisions while still requiring sellers to price appropriately.

How Reno-Sparks Compares to National Trends

Northern Nevada's market dynamics differ from national averages in important ways:

Sustained California Migration

The relocation pipeline from California remains strong and shows no signs of slowing. These buyers typically arrive well-qualified with substantial equity, supporting our local market even during periods of national uncertainty. If you're considering a move to Reno-Sparks from California, current rate conditions make the transition math even more compelling.

Tesla and Tech Employment Growth

EDAWN (Economic Development Authority of Western Nevada) continues reporting job growth in manufacturing, logistics, and technology sectors. The Tesla Gigafactory expansion and related supply chain development provide employment stability that supports housing demand.

Limited New Construction Constraints

Unlike some Sun Belt markets experiencing oversupply from builder activity, Northern Nevada faces zoning and infrastructure constraints that limit new housing development. This supply constraint supports existing home values and benefits sellers.

Regional Rate Variations

Some Nevada lenders offer rates slightly below national averages. Zillow's January 2026 data showed Nevada 30-year fixed rates around 5.99%—marginally better than Freddie Mac's national average. Shopping multiple lenders could yield further savings.

Expert Forecasts: What the Economists Expect Through 2026

The major housing economists broadly agree on 2026's direction, even if they differ on specifics:

NAR (National Association of Realtors)

- Home sales increase of approximately 14%

- Home prices up 2-3%

- Mortgage rates stabilizing around 6%

Redfin

- Existing home sales up 3%

- Home prices up 1%

- Mortgage rates averaging 6.3%

- "A stronger spring homebuying season in 2026"

MBA (Mortgage Bankers Association)

- Total originations up 8% to $2.2 trillion

- Purchase originations up 7.7%

- "Housing conditions to improve in 2026"

Fannie Mae

- Rates around 6% for most of 2026 and 2027

- Monthly payments declining for the first time since 2020

The consensus: improvement, not transformation. Conditions are getting better without becoming dramatically different. For buyers and sellers who've been waiting, "better" may be sufficient to act.

Making Your Move: Strategic Considerations for Spring 2026

For Sellers:

The window for strategic listing is opening. Buyers who've been monitoring rates are responding to improved conditions—purchase applications are up significantly, and economists predict strengthening spring activity. Consider these timing factors:

- February-March preparation allows April-May listing during peak buyer activity

- Properties listed before the spring inventory surge face less competition

- Homes showing well while temperatures are comfortable photograph better and show easier

- California relocators often target spring moves to allow summer settling before school starts

For Buyers:

Current conditions offer the best rate environment in three years, but hesitation carries risks. Consider:

- Get pre-approved now to know your precise budget at current rates

- Understand that rates may fluctuate—locking a rate when you find the right property protects your budget

- Explore Nevada's down payment assistance programs if upfront costs concern you

- Work with an agent who knows Reno-Sparks neighborhoods intimately to avoid overpaying in unfamiliar areas

The Bottom Line: Positive Momentum for Reno-Sparks Real Estate

The combination of rates at three-year lows, strengthening buyer demand, and gradually rebuilding inventory creates the most favorable conditions since 2021 for both sides of transactions. This isn't a prediction of dramatic change—economists aren't forecasting 4% rates or massive price corrections. Instead, it's a return toward normalcy after several years of extremes.

For Reno-Sparks specifically, the fundamentals remain strong: sustained California migration, employment growth from Tesla and tech sector expansion, and limited new construction protecting existing home values. Whether you're buying in Midtown, selling in South Reno, or navigating a simultaneous transaction from Sparks to Caughlin Ranch, current conditions support thoughtful real estate decisions.

Ready to explore what today's rate environment means for your specific situation? Contact Kevin Kinney at 775-391-8402 or Robin Renwick at 775-813-1255 to schedule a consultation. We'll analyze your neighborhood's current market position, discuss timing strategy, and create a plan aligned with your goals—whether that's maximizing sale proceeds, finding the right purchase, or coordinating both. The spring market is approaching. Let's make sure you're positioned to succeed.

FAQs

1. How low are mortgage rates right now compared to last year?

As of mid-January 2026, the 30-year fixed mortgage rate averaged 6.06% according to Freddie Mac—down nearly a full percentage point from 7.04% at the same time in 2025. This represents the lowest level since September 2022. For a buyer financing $500,000, this rate drop translates to approximately $330 less per month in principal and interest payments.

2. Are Reno-Sparks home prices going to drop because of lower rates?

Most economists forecast continued modest price appreciation of 1-3% nationally in 2026, not price declines. In Reno-Sparks specifically, the December 2025 median sale price was $549,000, up 5.2% from the prior year according to Redfin. Strong California migration and limited new construction continue supporting Northern Nevada values even as national markets moderate.

3. Should I buy now or wait for rates to drop further?

Fannie Mae forecasts rates staying around 6% through 2026 and 2027—significant further drops aren't expected. Meanwhile, the MBA reports purchase applications jumped 16% recently, indicating buyer competition is intensifying. Waiting for lower rates while more buyers enter the market could mean facing multiple offers on desirable properties. Current rates already represent three-year lows.

4. What does the "lock-in effect" mean for Reno sellers?

The lock-in effect describes homeowners' reluctance to sell and give up ultra-low pandemic-era mortgage rates. According to Realtor.com, the share of mortgages above 6% has now surpassed those below 3% for the first time, signaling this effect is easing. For Reno sellers, this means more inventory may enter the market—listing sooner, before that inventory surge, could be advantageous.

5. Are there down payment assistance programs available in Nevada?

Yes. Nevada's Home Is Possible program offers up to 4% of your loan amount for down payment and closing costs, forgivable after three years. The Home First program provides up to $15,000 in down payment support for first-time buyers who've been Nevada residents for at least six months. FHA loans remain available with down payments as low as 3.5%.

6. How will lower rates affect my ability to qualify for a mortgage?

Lower rates directly improve affordability and qualification. The monthly payment difference between 7% and 6% on a $500,000 loan is approximately $330. This difference affects debt-to-income calculations, potentially allowing buyers to qualify for larger loan amounts or more easily meet lender requirements at their target price point.

7. Is spring 2026 a good time to list my Reno-Sparks home?

Multiple indicators suggest yes. Freddie Mac's chief economist stated "housing activity is improving and poised for a solid spring sales season." NAR reported December 2025 sales were the strongest in nearly three years. More qualified buyers entering the market at improved rates creates favorable conditions for well-prepared, strategically priced listings.

8. How do current rates compare to what's considered historically "normal"?

Rates around 6% are actually normal by historical standards. The ultra-low 3% rates of 2020-2021 were anomalies driven by emergency Federal Reserve pandemic response—the only period below 3% since tracking began in 1971. Rates averaged 6-8% through most of the 1990s and 2000s. Current levels represent a return to historical norms, not elevated borrowing costs.